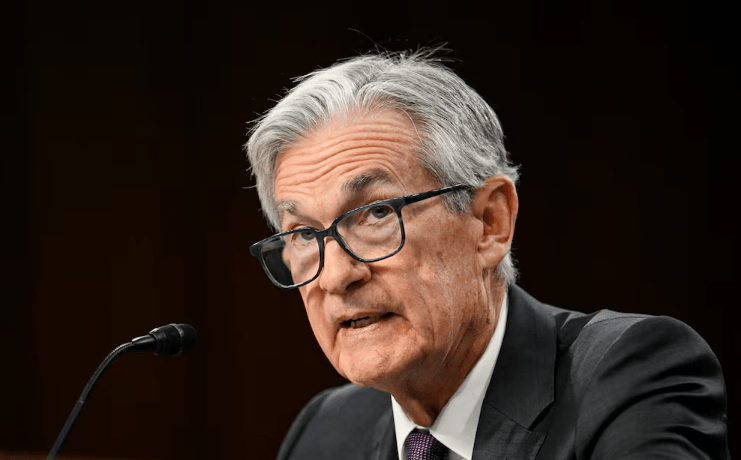

Federal Reserve Chair Jerome Powell reiterated on Tuesday that the central bank is not rushing to lower interest rates, emphasizing the need for caution amid a strong economy and easing inflation. Speaking before the Senate Banking Committee, Powell highlighted the Fed’s commitment to its 2% inflation target while noting that current economic conditions do not warrant immediate policy changes.

“With our policy stance now significantly less restrictive than it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance,” Powell said. He warned that moving too quickly to ease monetary policy could undermine progress on inflation, while delaying adjustments might weaken economic activity and employment.

Powell described the U.S. economy as “strong overall,” with a “solid” labor market and inflation that, while declining, remains above the Fed’s target. His remarks align with recent statements from Fed officials, who have signaled a pause in rate cuts following a full percentage point reduction in late 2024. The benchmark federal funds rate currently stands between 4.25% and 4.5%.

The hearing also touched on broader issues, including bank supervision and trade policy. Sen. Elizabeth Warren (D-Mass.) raised concerns about the Consumer Financial Protection Bureau’s diminished role under the Trump administration, questioning who oversees consumer compliance for large banks. Powell acknowledged that no other federal regulator currently fills that role but affirmed the overall safety of the banking system.

On trade, Powell avoided commenting directly on President Trump’s tariff policies, stating that trade policy falls outside the Fed’s mandate. “It’s not the Fed’s job to make or comment on tariff policy,” he said. “That’s for elected people, and it’s not for us to comment.”

Powell also addressed the disconnect between the Fed’s rate cuts and persistently high mortgage rates. He explained that mortgage rates are more closely tied to long-term Treasury yields than to the Fed’s short-term rate decisions. While he expressed optimism that mortgage rates could decline as the Fed maintains low rates, he offered no specific timeline.

Markets reacted minimally to Powell’s testimony, with stocks showing little change after an initial dip. Investors appear to have priced in the Fed’s cautious approach, expecting rates to remain steady into the summer.

As the Fed navigates an uncertain economic landscape, Powell emphasized the importance of flexibility. “We are attentive to the risks to both sides of our dual mandate,” he said, referring to the Fed’s goals of stable prices and maximum employment. “Policy is well positioned to deal with the risks and uncertainties that we face.”