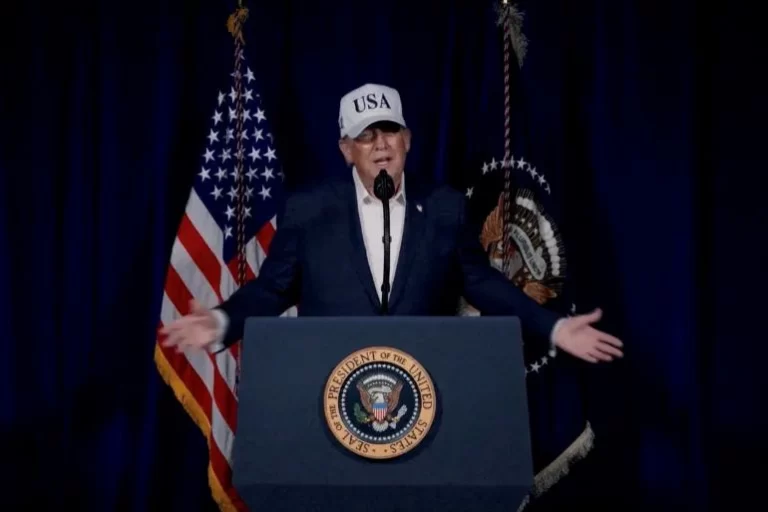

U.S. stock futures fell sharply Sunday night as investors weighed the potential economic impact of newly announced tariffs on goods from Mexico, Canada, and China. The move, introduced by President Donald Trump, has raised concerns about trade relations and corporate earnings, triggering a negative market response.

Futures tied to the Dow Jones Industrial Average dropped 463 points, or 1%, while S&P 500 futures declined 1.6%. The Nasdaq-100, which is heavily weighted with technology stocks, saw an even steeper decline of 2.1%.

The tariffs, set at 25% for imports from Canada and Mexico and 10% for Chinese goods, target major U.S. trading partners. Combined, these three countries account for approximately $1.6 trillion in annual trade with the United States. In response, Canada has announced retaliatory tariffs, Mexico is considering similar measures, and China has vowed to take the issue to the World Trade Organization.

Financial analysts warn that the market reaction could signal deeper investor concerns about the broader implications of trade disputes. Some experts suggest that markets may need to reassess the White House’s tariff strategy and its potential long-term consequences on economic growth and corporate profitability.

In commodities trading, oil and gasoline futures moved higher following the tariff announcement, while the U.S. dollar showed strength. Meanwhile, investors are also bracing for a significant week in corporate earnings, with over 120 companies in the S&P 500 scheduled to release financial results. Major firms such as Alphabet, Amazon, Walt Disney, and Mondelez are among those set to report, with tech stocks expected to face added scrutiny.

Additionally, market watchers are anticipating the release of the January nonfarm payrolls report on Friday. Economists polled by Dow Jones forecast 175,000 jobs added last month, with the unemployment rate holding steady at 4.1%. The data will provide further insight into the labor market and its resilience amid economic uncertainties.

Despite recent volatility, U.S. stocks ended January on a positive note. The S&P 500 gained 2.7%, the Nasdaq Composite rose 1.6%, and the Dow Jones Industrial Average saw a 4.7% increase for the month. However, escalating trade tensions could pose a challenge for continued market gains in the months ahead.