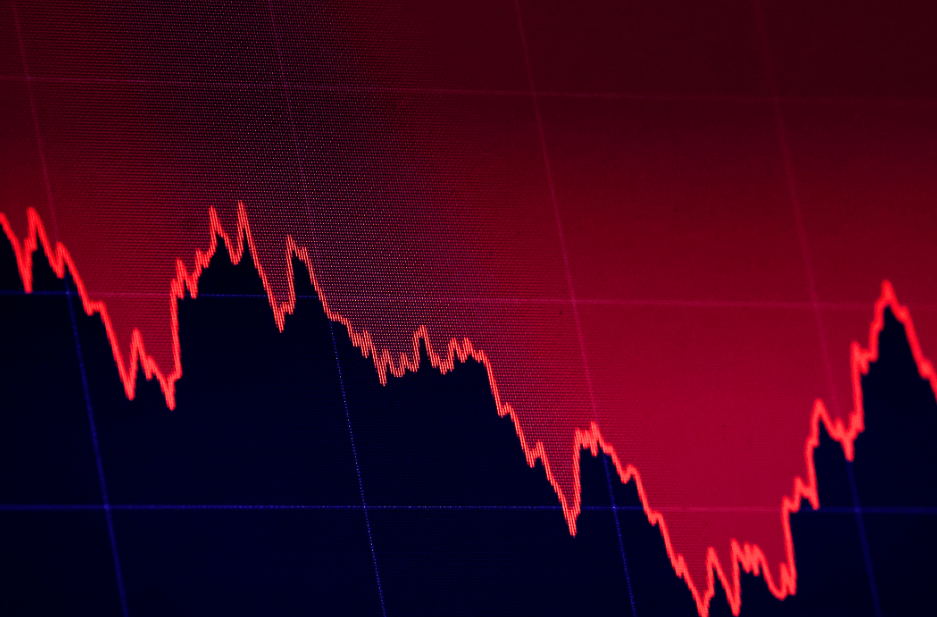

Stock markets experienced renewed volatility Tuesday as investors reacted to President Trump’s latest tariff threats, particularly those aimed at Canada. The S&P 500 dropped early in the session before recovering slightly, closing down 0.8%. The index is now close to a 10% decline from its mid-February peak, a level traditionally considered a market correction.

The Nasdaq Composite fluctuated throughout the day, ultimately losing 0.2% following a steep 4% drop on Monday. Airline and auto stocks also took a hit as uncertainty around trade policies fueled economic concerns.

Investor Concerns Grow Over Trade Policy

Market uncertainty intensified after Trump announced a planned tariff hike on Canadian steel and aluminum imports, increasing duties to 50%. The White House later softened its stance, contributing to some market stabilization. However, the president warned of additional tariffs on Canadian automobiles, a move that could have significant economic consequences.

The threat of heightened trade barriers rattled major automakers, with Ford and Stellantis seeing declines, while General Motors managed to recover. The airline sector was also under pressure after Delta Air Lines and American Airlines cited weakening demand, leading to stock drops of 7% and 8%, respectively.

Economic Outlook and Recession Fears

Analysts remain divided on the broader economic impact of the administration’s trade policies. While UBS increased the probability of a serious downturn, it maintained that a full recession remains unlikely. JPMorgan Chase estimated a 40% chance of a global recession, reflecting growing concerns among investors.

Uncertainty over tariffs comes at a time when business leaders and consumers are increasingly cautious about economic prospects. Despite current strength in economic data, sentiment surveys indicate a shift toward pessimism.

Global Market Reactions

The ripple effect of U.S. trade tensions was evident in international markets. Technology stocks in Japan, Taiwan, and South Korea recorded losses, with Sony, SoftBank, and Hitachi all falling by more than 2%. Automakers Toyota and Hyundai also saw declines amid concerns over potential new tariffs on foreign-made vehicles.

In contrast, Chinese markets remained relatively resilient. Investors in Hong Kong-listed Chinese companies have seen gains of about 20% this year, buoyed by the country’s pro-growth policies.